Teachers and others can deduct eligible educator expenses this year — and more next year and beyond

September 4, 2025 | Paula Kennedy, EA

New deductions available for teachers under the OBBBA. If you are a teacher you will want to read this!

Read MoreSeniors may be able to write off Medicare premiums

June 28, 2021 | Paula Kennedy, EA

Are you age 65 and older and have basic Medicare insurance? You may need to pay additional Medicare premiums to get the level of coverage you want. The premiums can be expensive, especially if you’re married and both you and your spouse are paying them. But there may be a bright side: You may qualify […]

Are your company’s job descriptions outdated?

June 28, 2021 | Brian Hare, CPA, CGMA

At many businesses, job descriptions have it easy. They were “hired” (that is, written) many years ago. They haven’t had to change or do anything, really, besides get copied and pasted into a want ad occasionally. They’re not really good at what they do, but they’re used again and again because everyone assumes they’re just […]

Don’t assume a profitable company has cash flow

June 16, 2021 | Brian Hare, CPA, CGMA

Most of us are taught from a young age never to assume anything. Why? Well, because when you assume, you make an … you probably know how the rest of the expression goes. A dangerous assumption that many business owners make is that, if their companies are profitable, their cash flow must also be strong. […]

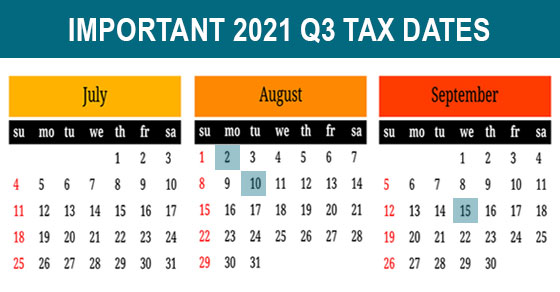

2021 Q3 tax calendar: Key deadlines

June 15, 2021 | Brian Hare, CPA, CGMA

Here are some of the key tax-related deadlines affecting businesses and other employers during the third quarter of 2021. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable 2021 Q3 tax calendar deadlines and to learn more about […]

Tax-favored ways to build up a college fund

June 15, 2021 | Megan Kosciolek, MST

If you’re a parent with a college-bound child, you may be concerned about being able to fund future tuition and other higher education costs. You want to take maximum advantage of tax benefits to minimize your expenses. Here are some possible options for college funds. Savings bonds Series EE U.S. savings bonds offer two tax-saving […]

File the Work Opportunity Tax Credit Online

June 14, 2021 | Akila Sivakumar

The Work Opportunity Tax Credit (WOTC) is a federal tax credit available to employers who hire from targeted groups of people who have historically had difficulty in securing employment. These targeted groups include qualified veterans, recipients of Temporary Assistance to Needy Families (TANF), food stamp recipients, ex-felons, and qualified long-term unemployment recipients. Historically, employers apply […]

Recordkeeping DOs and DON’Ts for business expenses

June 9, 2021 | Paula Kennedy, EA

If you’re claiming deductions for business meals or auto expenses, expect the IRS to closely review them. In some cases, taxpayers have incomplete documentation or try to create records months (or years) later. In doing so, they fail to meet the strict substantiation requirements set forth under tax law. Tax auditors are adept at rooting […]

Retiring soon? 4 tax issues you may experience

June 9, 2021 | Brian Hare, CPA, CGMA

If you are retiring soon, you maybe beginning experience changes in your lifestyle and income sources that may have numerous tax implications. Here’s a brief rundown of four tax and financial issues you may deal with when you are retiring: Taking required minimum distributions. This is the minimum amount you must withdraw from your retirement accounts. […]

Pondering the possibility of company retreats

June 9, 2021 | Brian Hare, CPA, CGMA

As vaccination levels rise and major U.S. population centers fully reopen, business owners may find themselves pondering an intriguing thought: Should we have company retreats this year? Although there are still health risks to consider, your employees may love the idea of attending an in-person event after so many months of video calls, emails and […]

Benefits of hiring your minor children this summer?

June 2, 2021 | Ryan Burke, CPA, MSF

If you’re a business owner and you hire your minor children this summer, you can obtain tax breaks and other nontax benefits. The kids can gain on-the-job experience, spend time with you, save for college and learn how to manage money. And you may be able to: Shift your high-taxed income into tax-free or low-taxed […]