Teachers and others can deduct eligible educator expenses this year — and more next year and beyond

September 4, 2025 | Paula Kennedy, EA

New deductions available for teachers under the OBBBA. If you are a teacher you will want to read this!

Read MoreStrong billing processes are critical to healthy cash flow

July 19, 2023 | Brian Hare, CPA, CGMA

Once a business is up and running, one fundamental aspect of operations that’s easy to take for granted is billing. Often, a system of various processes is put in place and leadership might consider occasional billing mistakes to be part of the “cost of doing business.” However, to keep your company financially fit, it’s imperative […]

Solo business owner? There’s a 401(k) for that

July 19, 2023 | Brian Hare, CPA, CGMA

If you own a successful small business with no employees, you might be ready to set up a retirement plan. Now a solo 401(k) might seem way out of your reach — only bigger companies can manage one of those, right? Not necessarily. Two ways to contribute With a solo 401(k), the self-employed can make large annual deductible contributions […]

Are you married and not earning compensation? You may be able to put money in an IRA

June 22, 2023 | Paula Kennedy, EA

If you are married and not earning a compensation, you can still save money for retirement in an IRA. Read on to know how.

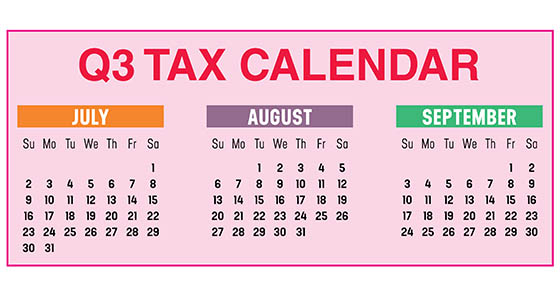

2023 Q3 tax calendar: Key deadlines for businesses and other employers

June 22, 2023 | Megan Kosciolek, MST

Quick list of Q3 tax deadlines for your business and other employers.

When can seniors deduct Medicare premiums on their tax returns?

June 14, 2023 | Ryan Burke, CPA, MSF

This blog lets you know when seniors can deduct Medicare premiums on their tax returns.

Advantages and disadvantages of claiming big first-year real estate depreciation deductions

June 14, 2023 | Paula Kennedy, EA

Claiming first year real estate depreciation deductions? Read on to learn about the advantages and disadvantages of doing so.

Are you being caught off guard receiving an SBA notice that you are delinquent on your Covid-EIDL debt?

June 13, 2023 | Kimberly Cosens

Interest is accuring on your Covid-EIDL loan. Read this blog to learn about how to make payments and not wait on monthly notices.

Reduce the impact of the 3.8% net investment income tax

June 7, 2023 | Jennifer Springer

If you are a high income tax payer you will want to read this blog to learn how to reduce the net investment income tax.

Traveling for business this summer? Here’s what you can deduct

June 7, 2023 | Megan Kosciolek, MST

Are you traveling for business this summer? You may be able to deduct more than you think. Read this blog to find out!

Benefits of a living trust for your estate

May 31, 2023 | Emma Harrison

Are you deciding on whether to provide a living trust for your estate? Read on to find out the benefits that this could have for you.