Teachers and others can deduct eligible educator expenses this year — and more next year and beyond

September 4, 2025 | Paula Kennedy, EA

New deductions available for teachers under the OBBBA. If you are a teacher you will want to read this!

Read MoreMedical expenses: Rules to qualify for a tax deduction

December 10, 2019 | Paula Kennedy, EA

As we all know, medical services and prescription drugs are expensive. You may be able to deduct some of your expenses on your tax return but the rules make it difficult for many people to qualify. However, with proper planning, you may be able to time discretionary medical expenses to your advantage for tax purposes. […]

Year-end tax-saving tools for your business

December 10, 2019 | Brian Hare, CPA, CGMA

At this time of year, many business owners ask if there’s anything they can do to save tax for the year. Under current tax law, there are two valuable depreciation-related tax breaks that may help your business reduce its 2019 tax liability. To benefit from these deductions, you must buy eligible machinery, equipment, furniture or […]

How to claim a settlement from Visa/Mastercard

December 2, 2019 | Janet Kanan, EA

VISA/Mastercard Settlement to Merchants On December 13, 2019 the Court granted final approval to a settlement filed on September 18, 2018 in the amount of $5.54 billion. The lawsuit is about claims that merchants paid excessive fees to accept Visa and Mastercard cards because Visa and Mastercard, individually, and together with their respective member banks, […]

Tax implications with environmental cleanup

November 25, 2019 | Brian Hare, CPA, CGMA

If your company faces the need to “remediate” or clean up environmental contamination, the money you spend can be deductible on your tax return as ordinary and necessary business expenses. Of course, you want to claim the maximum immediate income tax benefits possible for the expenses you incur. These expenses may include the actual cleanup […]

What is your taxpayer filing status?

November 25, 2019 | Paula Kennedy, EA

For tax purposes, December 31 means more than New Year’s Eve celebrations. It affects the filing status box that will be checked on your tax return for the year. When you file your return, you do so with one of five filing statuses, which depend in part on whether you’re married or unmarried on December […]

The gap between budgeting and risk management

November 22, 2019 | Brian Hare, CPA, CGMA

At many companies, a wide gap exists between the budgeting process and risk management. Failing to consider major threats could leave you vulnerable to high-impact hits to your budget if one or more of these dangers materialize. Here are some common types of risks to research, assess and incorporate into adjustments to next year’s budget: […]

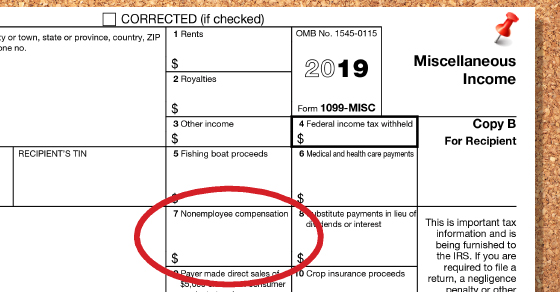

Get ready for your 1099-MISC reporting requirements

November 15, 2019 | Janet Kanan, EA

A month after the new year begins, your business may be required to comply with rules to report amounts paid to independent contractors, vendors and others. You may have to send 1099-MISC forms to those whom you pay non-employee compensation, as well as file copies with the IRS. This task can be time consuming and […]

Using your 401(k) plan to save this year and next

November 15, 2019 | Paula Kennedy, EA

You can reduce taxes and save for retirement by contributing to a tax-advantaged retirement plan. If your employer offers a 401(k) or Roth 401(k) plan, contributing to it is a taxwise way to build a nest egg. If you’re not already contributing the maximum allowed, consider increasing your contribution rate between now and year end. […]

3 key traits of every successful salesperson

November 15, 2019 | Brian Hare, CPA, CGMA

Take a mental snapshot of your sales staff. Do only a few of its members consistently bring in high volumes of good margin sales? An old rule of thumb says that about 20% of salespeople will make 80% of sales; in other words, everyone’s not going to be a superstar. However, you can create performance […]

Small businesses: Severe payroll tax penalty

November 8, 2019 | Brian Hare, CPA, CGMA

One of the most laborious tasks for small businesses is managing payroll. But it’s critical that you not only withhold the right amount of taxes from employees’ paychecks but also that you pay them over to the federal government on time. If you willfully fail to do so, you could personally be hit with the […]