Changes to charitable donation deductions are on the horizon

December 18, 2025 | Kimberly Cosens

Those who itemize deductions and donate to charity will be seeing some changes in 2026. Read on to find out what to expect.

Read MoreTax considerations when adding a new partner

April 19, 2022 | Brian Hare, CPA, CGMA

Adding a new partner in a partnership has several financial and legal implications. Let’s say you and your partners are planning to admit a new partner. The new partner will acquire a one-third interest in the partnership by making a cash contribution to it. Let’s further assume that your bases in your partnership interests are […]

Converting your home into a rental property?

April 19, 2022 | Ryan Burke, CPA, MSF

In some cases, homeowners decide to move to new residences, but keep their present homes as a rental property. If you’re thinking of doing this, you’re probably aware of the financial risks and rewards. However, you also should know that renting out your home carries potential tax benefits and pitfalls. You’re generally treated as a […]

Converting from a C corporation to an S corporation

April 14, 2022 | Brian Hare, CPA, CGMA

Operating as an S corporation may help reduce federal employment taxes for small businesses in the right circumstances. Although S corporations may provide tax advantages over C corporations, there are some potentially costly tax issues that you should assess before making a decision to switch. Here’s a quick rundown of the most important issues to […]

Once you file your tax return, consider these 3 issues

April 14, 2022 | Paula Kennedy, EA

The tax filing deadline for 2021 tax returns is April 18 this year. After your 2021 tax return has been successfully filed with the IRS, there may still be some issues to bear in mind. Here are three considerations: 1. You can throw some tax records away now You should hang onto tax records related […]

Offering summer jobs? Double-check child labor laws

April 14, 2022 | Brian Hare, CPA, CGMA

Spring has sprung — and summer isn’t far off. If your business typically hires minors for summer jobs, now’s a good time to brush up on child labor laws. In News Release No. 22-546-DEN, the U.S. Department of Labor’s Wage and Hour Division (WHD) recently announced that it’s stepping up efforts to identify child labor […]

Artificial Intelligence for businesses

April 6, 2022 | Brian Hare, CPA, CGMA

Artificial intelligence (AI) has made great inroads into certain sectors of the U.S. economy. However, it hasn’t reached many small to midsize businesses (SMBs) in a major way … yet. In 2021, AI analysis firm Unsupervised published a survey of 520 SMB owners that found 48% of them still found AI too cost prohibitive. Forty […]

Businesses can fully deduct meals from restaurants

April 5, 2022 | Megan Kosciolek, MST

The federal government is helping to pick up the tab for certain business meals. Under a provision that’s part of one of the COVID-19 relief laws, the usual deduction for 50% of the cost of business meals is doubled to 100% for food and beverages provided by restaurants in 2022 (and 2021). So, you can […]

Selling mutual fund shares: What are the tax implications?

April 5, 2022 | Paula Kennedy, EA

If you’re an investor in mutual funds or you’re interested in putting some money into them, you’re not alone. According to the Investment Company Institute, a survey found 58.7 million households owned mutual funds in mid-2020. But despite their popularity, the tax rules involved in selling mutual fund shares can be complex. What are the […]

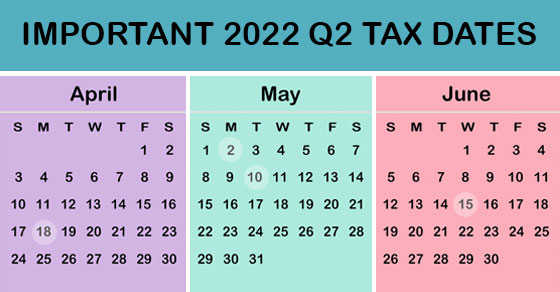

2022 Q2 tax calendar: Key deadlines

March 30, 2022 | Paula Kennedy, EA

Here are some of the key tax-related deadlines that apply to businesses and other employers during the second quarter of 2022. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing […]

Tax Filing Deadline: If you’re not ready, file an extension

March 30, 2022 | Paula Kennedy, EA

The clock is ticking down to the April 18 tax filing deadline. Sometimes, it’s not possible to gather your tax information and file by the due date. If you need more time, you should file for an extension on Form 4868. An extension will give you until October 17 to file and allows you to […]