Payroll tax implications of new tax breaks on tips and overtime

September 17, 2025 | Jennifer Springer

Do you have a career that you get tips or overtime? New tax breaks could be available to you soon.

Read MoreWork Opportunity Tax Credit provides help to employers

October 1, 2022 | Megan Kosciolek, MST

In today’s tough job market and economy, the Work Opportunity Tax Credit (WOTC) may help employers. Many business owners are hiring and should be aware that the WOTC is available to employers that hire workers from targeted groups who face significant barriers to employment. The credit is worth as much as $2,400 for each eligible […]

Year-end tax planning ideas for individuals

September 28, 2022 | Paula Kennedy, EA

Now that fall is officially here, it’s a good time to start taking steps that may lower your tax bill for this year and next. One of the first planning steps is to ascertain whether you’ll take the standard deduction or itemize deductions for 2022. Many taxpayers won’t itemize because of the high 2022 standard […]

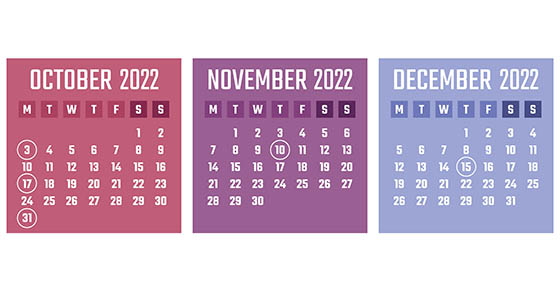

2022 Q4 tax calendar: Key deadlines for businesses and other employers

September 24, 2022 | Brian Hare, CPA, CGMA

Here are some of the key tax-related deadlines affecting businesses and other employers during the fourth quarter of 2022. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements. Note: […]

Don’t forget income taxes when planning your estate

September 22, 2022 | Brian Hare, CPA, CGMA

As a result of the current estate tax exemption amount ($12.06 million in 2022), many estates no longer need to be concerned with federal estate tax. Before 2011, a much smaller amount resulted in estate plans attempting to avoid it. But now, because many estates won’t be subject to estate tax, more planning can be […]

Separating your business from its real estate

September 16, 2022 | Brian Hare, CPA, CGMA

Does your business need real estate to conduct operations? Or does it otherwise hold property and put the title in the name of the business? You may want to rethink this approach. Any short-term benefits may be outweighed by the tax, liability and estate planning advantages of separating real estate ownership from the business. Tax […]

Seller-paid points: Can homeowners deduct them?

September 14, 2022 | Paula Kennedy, EA

In its latest report, the National Association of Realtors (NAR) announced that July 2022 existing home sales were down but prices were up nationwide, compared with last year. “The ongoing sales decline reflects the impact of the mortgage rate peak of 6% in early June,” said NAR Chief Economist Lawrence Yun. However, he added that […]

Year-end tax planning ideas for your small business

September 9, 2022 | Brian Hare, CPA, CGMA

Now that Labor Day has passed, it’s a good time to think about making moves that may help lower your small business taxes for this year and next. The standard year-end approach of deferring income and accelerating deductions to minimize taxes will likely produce the best results for most businesses, as will bunching deductible expenses […]

Is your income high enough to owe two extra taxes?

September 7, 2022 | Ryan Burke, CPA, MSF

High-income taxpayers face two special taxes — a 3.8% net investment income tax (NIIT) and a 0.9% additional Medicare tax on wage and self-employment income. Here’s an overview of the taxes and what they may mean for you. 3.8% NIIT This tax applies, in addition to income tax, on your net investment income. The NIIT […]

Inflation Reduction Act provisions of interest to small businesses

September 1, 2022 | Brian Hare, CPA, CGMA

The new Inflation Reduction Act provides small businesses with an incentive to increase their investments in research.

The Inflation Reduction Act: what’s in it for you?

September 1, 2022 | Akila Sivakumar

If you’re interested in purchasing energy-saving property for your home or an electric vehicle, you may qualify for a tax break under the new Inflation Reduction Act. Here are the basic rules.