Teachers and others can deduct eligible educator expenses this year — and more next year and beyond

September 4, 2025 | Paula Kennedy, EA

New deductions available for teachers under the OBBBA. If you are a teacher you will want to read this!

Read MoreYou may be liable for “nanny tax” for all types of domestic workers

October 31, 2022 | Paula Kennedy, EA

You’ve probably heard of the “nanny tax.” But even if you don’t employ a nanny, it may apply to you. Hiring a house cleaner, gardener or other household employee (who isn’t an independent contractor) may make you liable for federal income and other taxes. You may also have state tax obligations. If you employ a […]

Providing fringe benefits to employees with no tax strings attached

October 24, 2022 | Brian Hare, CPA, CGMA

Businesses can provide benefits to employees that don’t cost them much or anything at all. However, in some cases, employees may have to pay tax on the value of these benefits. Here are examples of two types of benefits which employees generally can exclude from income: A no-additional-cost benefit. This involves a service provided to […]

Plan now to make tax-smart year-end gifts to loved ones

October 19, 2022 | Paula Kennedy, EA

Are you feeling generous at year end? Taxpayers can transfer substantial amounts free of gift taxes to their children or other recipients each year through the proper use of the annual exclusion. The exclusion amount is adjusted for inflation annually, and for 2022, the amount is $16,000. The exclusion covers gifts that an individual makes […]

What local transportation costs can your business deduct?

October 15, 2022 | Brian Hare, CPA, CGMA

You and your small business are likely to incur a variety of local transportation costs each year. There are various tax implications for these expenses. First, what is “local transportation?” It refers to travel in which you aren’t away from your tax home (the city or general area in which your main place of business […]

Tax and other financial consequences of tax-free bonds

October 12, 2022 | Janet Kanan, EA

If you’re interested in investing in tax-free municipal bonds, you may wonder if they’re really free of taxes. While the investment generally provides tax-free interest on the federal (and possibly state) level, there may be tax consequences. Here’s how the rules work. Purchasing a bond If you buy a tax-exempt bond for its face amount, […]

Worried about an IRS audit? Prepare in advance

October 10, 2022 | Megan Kosciolek, MST

IRS audit rates are historically low, according to a recent Government Accountability Office (GAO) report , but that’s little consolation if your return is among those selected to be examined. Plus, the IRS recently received additional funding in the Inflation Reduction Act to improve customer service, upgrade technology and increase audits of high-income taxpayers. But […]

Investing in the future with a 529 education plan

October 6, 2022 | Brian Hare, CPA, CGMA

If you have a child or grandchild who’s going to attend college in the future, you’ve probably heard about qualified tuition programs, also known as 529 plans. These plans, named for the Internal Revenue Code section that provides for them, allow prepayment of higher education costs on a tax-favored basis. There are two types of […]

Work Opportunity Tax Credit provides help to employers

October 1, 2022 | Megan Kosciolek, MST

In today’s tough job market and economy, the Work Opportunity Tax Credit (WOTC) may help employers. Many business owners are hiring and should be aware that the WOTC is available to employers that hire workers from targeted groups who face significant barriers to employment. The credit is worth as much as $2,400 for each eligible […]

Year-end tax planning ideas for individuals

September 28, 2022 | Paula Kennedy, EA

Now that fall is officially here, it’s a good time to start taking steps that may lower your tax bill for this year and next. One of the first planning steps is to ascertain whether you’ll take the standard deduction or itemize deductions for 2022. Many taxpayers won’t itemize because of the high 2022 standard […]

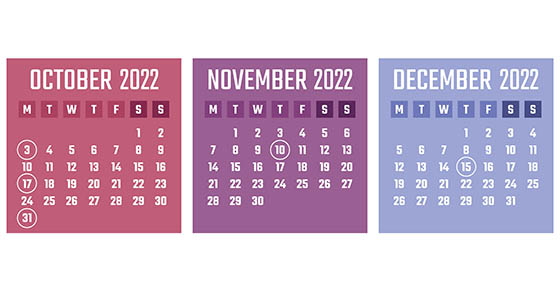

2022 Q4 tax calendar: Key deadlines for businesses and other employers

September 24, 2022 | Brian Hare, CPA, CGMA

Here are some of the key tax-related deadlines affecting businesses and other employers during the fourth quarter of 2022. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements. Note: […]