Teachers and others can deduct eligible educator expenses this year — and more next year and beyond

September 4, 2025 | Paula Kennedy, EA

New deductions available for teachers under the OBBBA. If you are a teacher you will want to read this!

Read MoreAre scholarships tax-free or taxable?

October 18, 2023 | Jennifer Springer

Ever wonder if your scholarship is tax free? Read this blog to find out what scholarships are tax free and which ones are taxable.

Business automobiles: How the tax depreciation rules work

October 17, 2023 | Kimberly Cosens

Do you use your personal vehicle for business? Read on to discover the tax depreciation rules and how to benefit from them.

The tax implications of renting out a vacation home

October 12, 2023 | Paula Kennedy, EA

Many Americans own a vacation home or aspire to purchase one. If you own a second home in a waterfront community, in the mountains or in a resort area, you may want to rent it out for part of the year. The tax implications of these transactions can be complicated. It depends on how many […]

How IRS auditors learn about your business industry

October 12, 2023 | Emma Harrison

Ever wonder how IRS Auditors learn about your business industry and what to watch out for on your returns? Read on to find out.

What are the tax implications of winning money or valuable prizes?

October 4, 2023 | Emma Harrison

Were you lucky enough to win the lottery or have a good hand in your last poker game? Read on to discover the tax consequences..

What types of expenses can’t be written off by your business?

October 4, 2023 | Megan Kosciolek, MST

Before you write your business expenses off this tax season, know what qualifies as an expense by the IRS standards.

Hare CPAs 2023 – 2024 Tax Planning Guide Release

October 2, 2023 | Brian Hare, CPA, CGMA

We are happy to release our 2023 -2024 Tax Planning Guide. This guide includes information and guidance for both businesses and individuals. If you have questions or if you would like additional information, please contact us.

Top 5 Reasons to Work at Hare CPAs

September 28, 2023 | Caleb Pulst

Promotes, Builds, Strives, Commits and Supports, 5 Great Words to promote the reasons to work for Hare CPAs! Read on to learn more about this great company!

Casualty loss tax deductions may help disaster victims in certain cases

September 27, 2023 | Megan Kosciolek, MST

Natural disasters can happen anywhere, and to anyone. If you have been affected please read this article to learn about Casualty loss tax deductions.

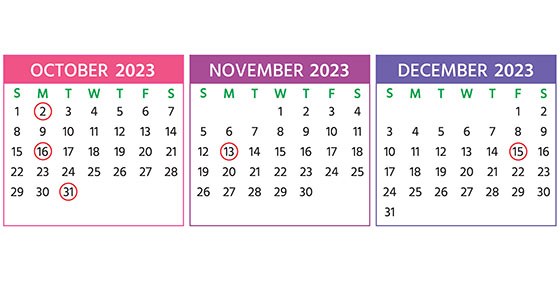

2023 Q4 tax calendar: Key deadlines for businesses and other employers

September 27, 2023 | Brian Hare, CPA, CGMA

Key tax deadlines affecting business and employers.