There’s still time to set up a SEP and reduce your 2025 taxes

January 28, 2026 | Brian Hare, CPA, CGMA

If you’re looking to set up a tax-advantaged retirement plan, consider choosing a SEP. Read about the deadlines, set up, and contributions to see if it’s right for your business.

Read MoreHow the new Trump Accounts for children will work

January 28, 2026 | Megan Kosciolek, MST

With the One Big Beautiful Bill Act has come a new program – Trump Accounts. Read to learn how Trump Accounts can help your children or grandchildren build savings for the future.

Is your business ready for the tax deadline that’s on Groundhog Day this year?

January 21, 2026 | Jennifer Springer

With the arrival of tax season comes a variety of forms your business must furnish. Here are some of the forms and deadlines you need to know.

Tax filing FAQs for individuals

January 21, 2026 | Megan Kosciolek, MST

The 2025 tax filing season has arrived! Read this blog to get answers to some frequently asked questions about filing.

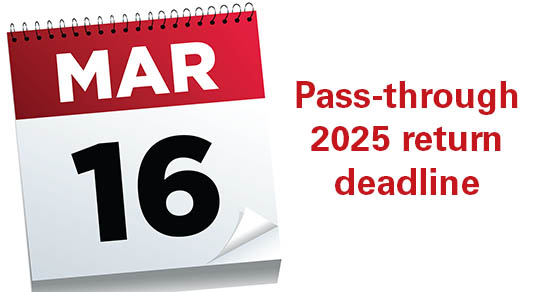

Tax filing update for pass-through entities

January 14, 2026 | Kaitria LaFleure

If you operate a pass-through entity, the One Big, Beautiful Bill Act includes several changes that will affect your 2025 tax return. Read to find out more.

When medical expenses are — and aren’t — tax deductible

January 14, 2026 | Caleb Pulst

Did you have significant medical expenses last year? Eligible medical expenses go beyond hospital bills. Read to learn what medical expenses may be deductible on your 2025 income tax return.

Not all “business” expenses are tax deductible

January 9, 2026 | Kimberly Cosens

The cost of capital is a critical input in DCF models. Read this article to learn more about how it effects the value of your business.

If you suffered a disaster, you may be eligible for a casualty loss tax deduction

January 9, 2026 | Megan Kosciolek, MST

Have you experienced casualty losses as a result of a disaster? Read this article to discover how OBBBA can help you in the 2026 tax year.

A new year means new tax figures for individuals

December 30, 2025 | Paula Kennedy, EA

2026 brings new tax figures for individuals. Read this blog to find out how you may be affected.

Important 2026 tax figures for businesses

December 30, 2025 | Megan Kosciolek, MST

This blog is an important read for business owners. This contains the new 2026 tax figures for businesses.

More individuals with disabilities will be eligible for tax-advantaged ABLE accounts in 2026

December 30, 2025 | Caleb Pulst

Individuals with disabilities will be eligible for tax- advantage ABLE accounts and under the new OBBBA law, new requirements apply.