by Brian Hare, CPA, CGMA | Nov 9, 2023 | Uncategorized

If you’re planning to start a business or thinking about changing your business entity, you need to determine what will work best for you. Should you operate as a C corporation or a pass-through entity such as a sole-proprietorship, partnership, limited liability...

by Brian Hare, CPA, CGMA | Nov 1, 2023 | Blog, Business, Tax, Uncategorized

Are employees at your business traveling and frustrated about documenting expenses? Or perhaps you’re annoyed at the time and energy that goes into reviewing business travel expenses. There may be a way to simplify the reimbursement of these expenses. In Notice...

by Brian Hare, CPA, CGMA | Oct 2, 2023 | Uncategorized

We are happy to release our 2023 -2024 Tax Planning Guide. This guide includes information and guidance for both businesses and individuals. If you have questions or if you would like additional information, please contact us.

by Brian Hare, CPA, CGMA | Sep 27, 2023 | Business, Tax, Uncategorized

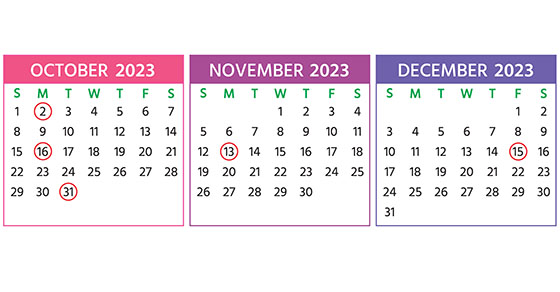

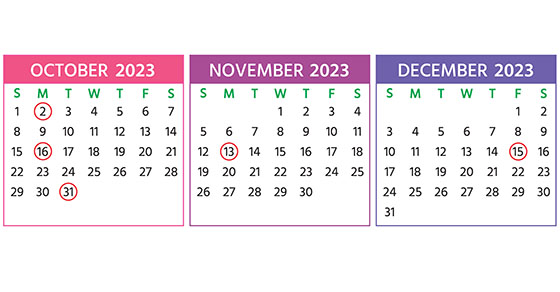

Here are some of the key tax-related deadlines affecting businesses and other employers during the fourth quarter of 2023. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact Hare CPAs to ensure you’re...

by Brian Hare, CPA, CGMA | Aug 21, 2023 | Tax

If you have family members with disabilities, there may be a tax-advantaged way to save for their needs — without having them lose eligibility for the government benefits to which they’re entitled. It can be done though an Achieving a Better Life Experience (ABLE)...