by Brian Hare, CPA, CGMA | Mar 14, 2024 | Uncategorized

The qualified business income (QBI) deduction is available to eligible businesses through 2025. After that, it’s scheduled to disappear. So if you’re eligible, you want to make the most of the deduction while it’s still on the books because it can potentially be a big...

by Brian Hare, CPA, CGMA | Feb 28, 2024 | Blog, Business, Tax

If you want to withdraw cash from your closely held corporation at a low tax cost, the easiest way is to distribute cash as a dividend. However, a dividend distribution isn’t tax efficient since it’s taxable to you to the extent of your corporation’s “earnings and...

by Brian Hare, CPA, CGMA | Jan 17, 2024 | Business, Tax, Uncategorized

Operating your small business as a Qualified Small Business Corporation (QSBC) could be a tax-wise idea. Tax-free treatment for eligible stock gains QSBCs are the same as garden-variety C corporations for tax and legal purposes — except QSBC shareholders are...

by Brian Hare, CPA, CGMA | Dec 19, 2023 | Business, Tax, Uncategorized

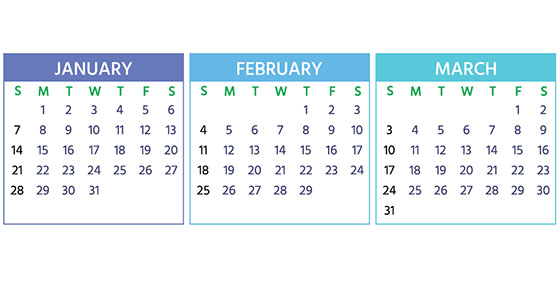

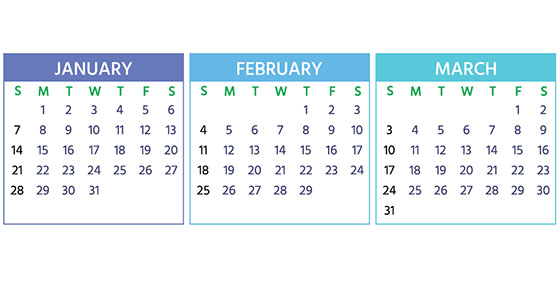

Here are some of the key tax-related deadlines affecting businesses and other employers during the first quarter of 2024. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. If you have questions about filing...

by Brian Hare, CPA, CGMA | Nov 22, 2023 | Blog, Business, Tax, Uncategorized

The IRS recently announced various inflation-adjusted federal income tax amounts. Here’s a rundown of the amounts that are most likely to affect small businesses and their owners. Rates and brackets If you run your business as a sole proprietorship or pass-through...