by Brian Hare, CPA, CGMA | Oct 6, 2022 | Blog, Tax

If you have a child or grandchild who’s going to attend college in the future, you’ve probably heard about qualified tuition programs, also known as 529 plans. These plans, named for the Internal Revenue Code section that provides for them, allow prepayment of higher...

by Brian Hare, CPA, CGMA | Sep 24, 2022 | Blog, Business, Tax

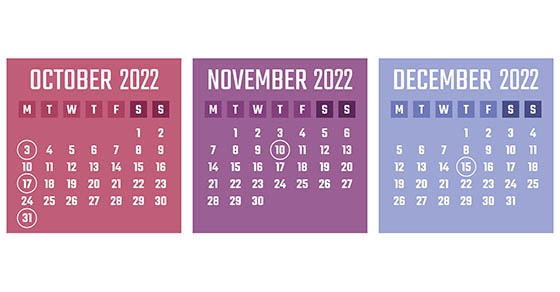

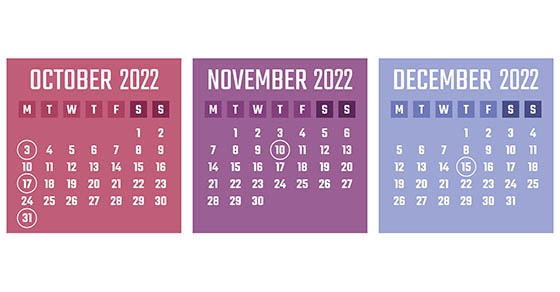

Here are some of the key tax-related deadlines affecting businesses and other employers during the fourth quarter of 2022. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all...

by Brian Hare, CPA, CGMA | Sep 22, 2022 | Estate Planning, Tax

As a result of the current estate tax exemption amount ($12.06 million in 2022), many estates no longer need to be concerned with federal estate tax. Before 2011, a much smaller amount resulted in estate plans attempting to avoid it. But now, because many estates...

by Brian Hare, CPA, CGMA | Sep 16, 2022 | Blog, Tax

Does your business need real estate to conduct operations? Or does it otherwise hold property and put the title in the name of the business? You may want to rethink this approach. Any short-term benefits may be outweighed by the tax, liability and estate planning...

by Brian Hare, CPA, CGMA | Sep 9, 2022 | Blog, Business, Tax

Now that Labor Day has passed, it’s a good time to think about making moves that may help lower your small business taxes for this year and next. The standard year-end approach of deferring income and accelerating deductions to minimize taxes will likely produce the...