by Paula Kennedy, EA | Apr 14, 2022 | Tax

The tax filing deadline for 2021 tax returns is April 18 this year. After your 2021 tax return has been successfully filed with the IRS, there may still be some issues to bear in mind. Here are three considerations: 1. You can throw some tax records away now You...

by Paula Kennedy, EA | Apr 5, 2022 | Tax

If you’re an investor in mutual funds or you’re interested in putting some money into them, you’re not alone. According to the Investment Company Institute, a survey found 58.7 million households owned mutual funds in mid-2020. But despite their popularity, the tax...

by Paula Kennedy, EA | Mar 30, 2022 | Tax

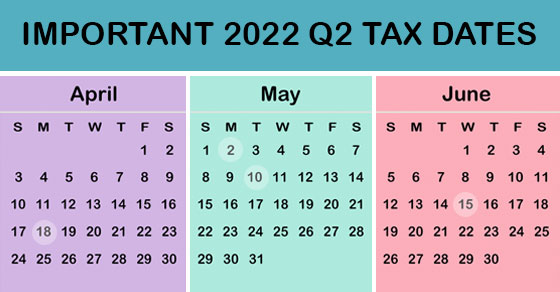

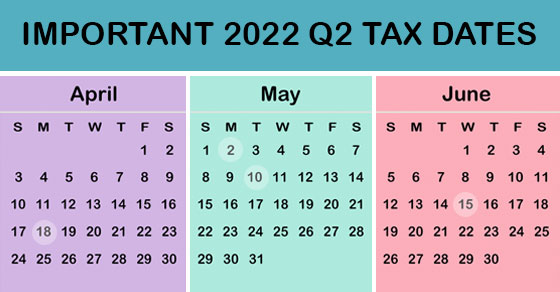

Here are some of the key tax-related deadlines that apply to businesses and other employers during the second quarter of 2022. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting...

by Paula Kennedy, EA | Mar 30, 2022 | Tax

The clock is ticking down to the April 18 tax filing deadline. Sometimes, it’s not possible to gather your tax information and file by the due date. If you need more time, you should file for an extension on Form 4868. An extension will give you until October 17 to...

by Paula Kennedy, EA | Mar 22, 2022 | Tax

Summer is just around the corner. If you’re fortunate enough to own a vacation property, you may wonder about the tax consequences of renting it out for part of the year. The tax treatment depends on how many days it’s rented and your level of personal use. Personal...